Discounted cash flow calculator online

You can find company. Discounted Cash Flow analysis is widely used in finance.

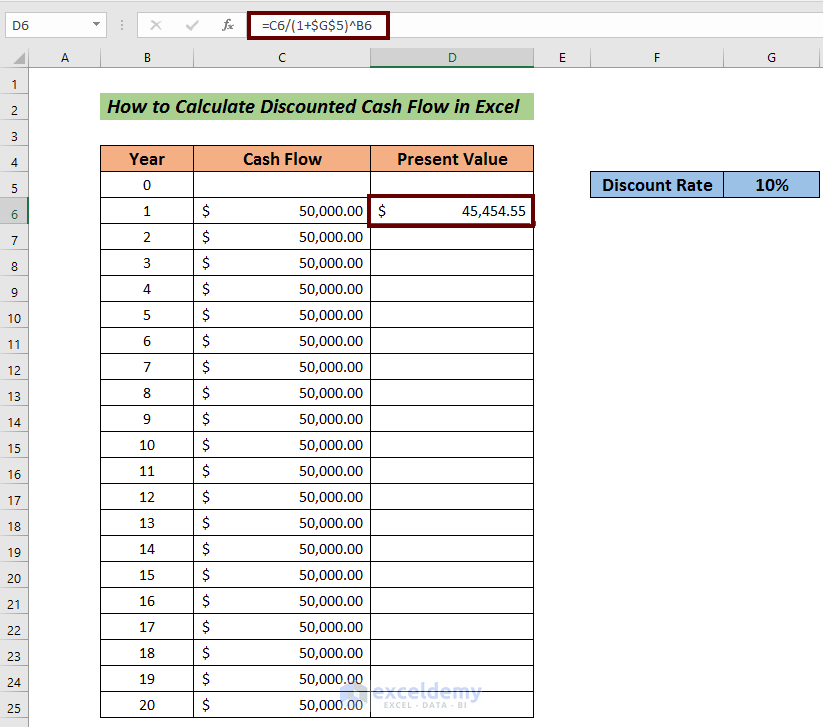

How To Calculate Discounted Cash Flow In Excel With Easy Steps

The DCF method can be used for the companies which have positive Free cash flows and these FCFF can be reasonably forecasted.

. The income approach the cost approach or the market comparable sales approach. The discounted cash flow is a quantification method used to evaluate the attractiveness of an investment opportunityDiscounted Cash Flow is a term used to describe what your future cash. Discounted Cash Flow Calculator Online.

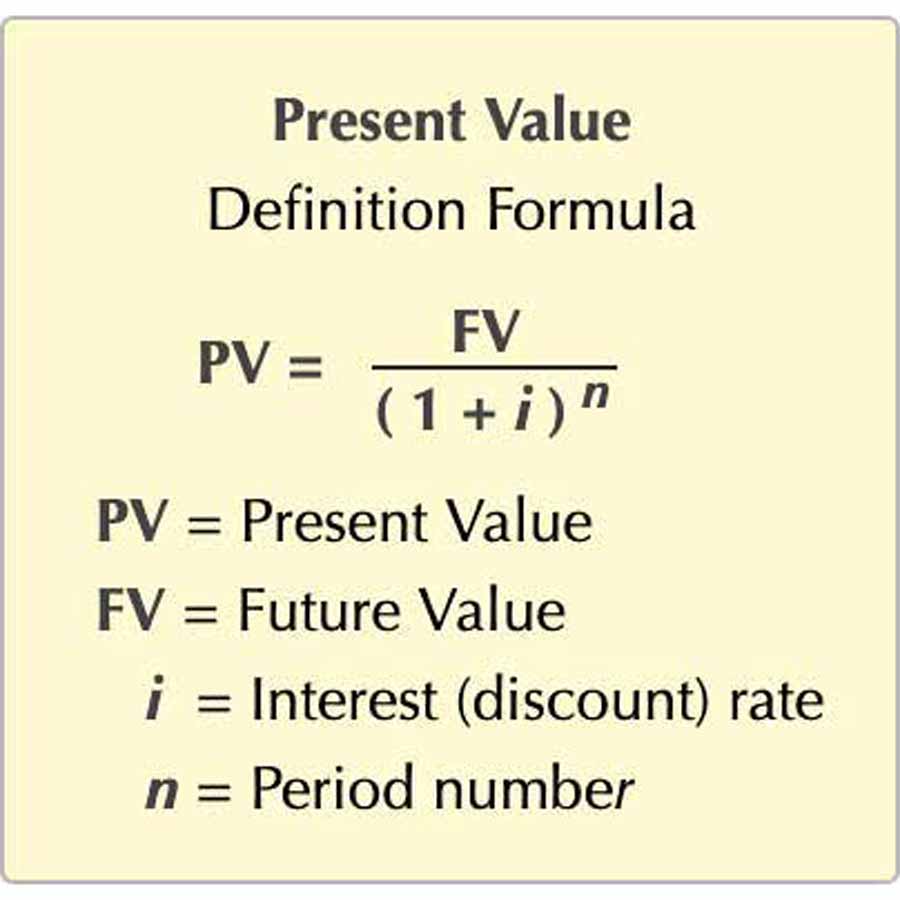

Discounted Cash Flow DCF Text. Instructions Please enter the following details regarding the stock whose intrinsic value you are. If our total number of periods is N the equation for the present value of the cash flow series is the summation of individual cash flows.

Initial FCF Rs Cr Take 3 Years average. This calculator finds the fair value of a stock investment the theoretically correct way as the present value of future earnings. Cash Flow Growth Rate.

P V n C F n 1 i n n. Import your historical financial numbers and your projection for 3 to 5 years later. Find the intrinsic value of a company with our simplified DCF calculator.

Ad QuickBooks Financial Software. DCF Tool is a calculator that performs valuation of stocks using the Discounted Cash Flow method. Discounted Cash Flow Calculator Online.

Must be text. Then regarding to your market. Three steps in startup valuation with Discounted Cash Flows.

Start tracking your investments today 14-day Premium trial 100 free after. To calculate the enterprise value the present value of cash flows for the years from now till the end of the forecast period are divided by the discount rate and then added. Business valuation BV is typically based on one of three methods.

Discount Rate Perpetuity Growth Rate. Heres our Discounted Cash Flow DCF Calculator for your ease of calculation so that you dont have to break your head in complicated excel sheets. So it cannot be used for new and small companies or.

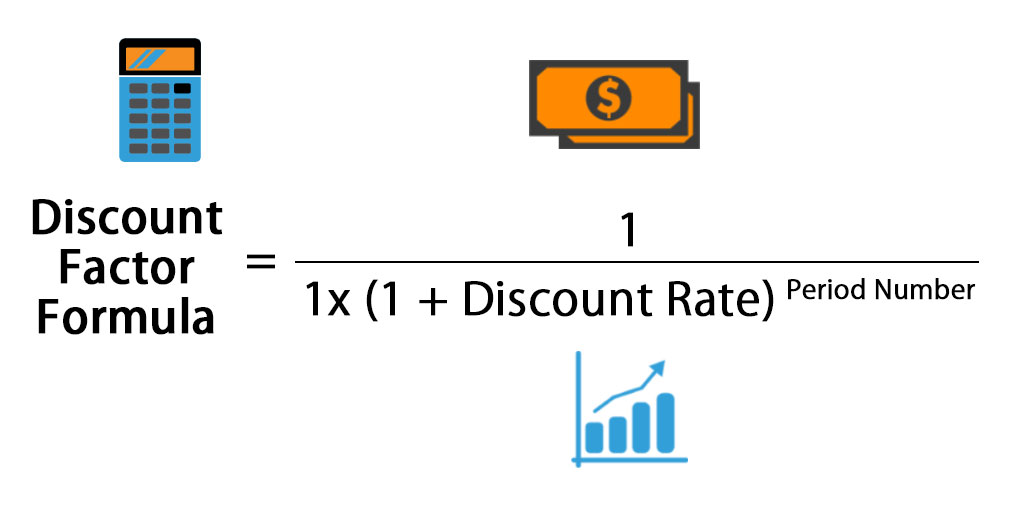

The DCF for each period is calculated as follows - we multiply the actual cash flows with the PV factor. From that we can. The fair value of a.

What do You Consider Short Term. DCF analysis aims to determine the current value of an. Rated the 1 Accounting Solution.

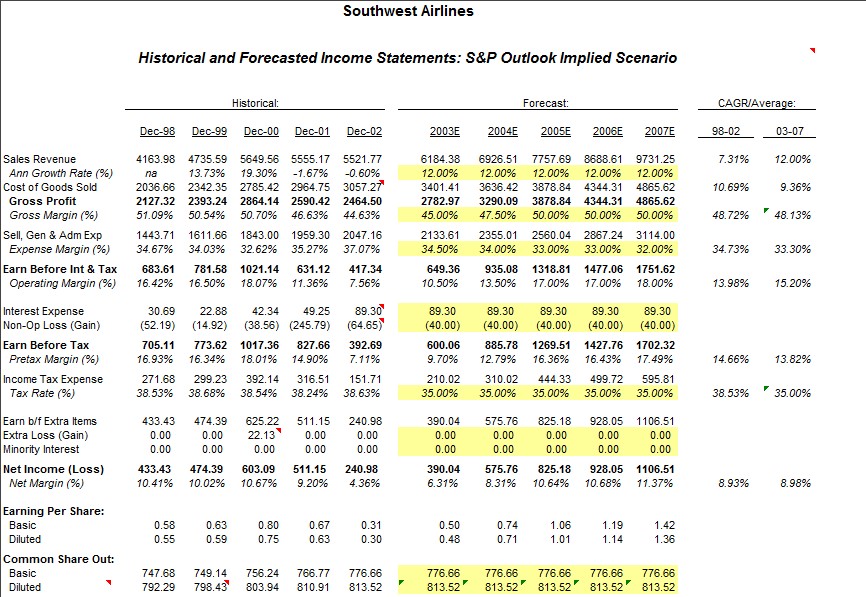

Ad 93 of small business owners are constantly leaking money on useless and unnoticed things. P V n 0 N C F n 1 i n n. Historical financial data and growth modeling are used to forecast future cash flows.

You will find many more tools to become a better investor such as the Discounted Cash Flow calculator. Discounted cash flow DCF is a valuation method that uses predicted future cash flows to determine the value of an investment. If the discount rate is 10 then we can calculate the DPP.

Discounted Cash Flows Calculator. A discounted cash flow analysis is a method of asset or company valuation. Get 3 cash flow strategies to stop leaking overpaying and wasting your money.

Discounted Cash Flow Calculator. Online calculator for Discounted Cash Flow DCF stock analysis.

Free Discounted Cash Flow Templates Smartsheet

Mid Year Convention Discounting Adjustment And Calculator Excel Template

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

How To Use Discounted Cash Flow Time Value Of Money Concepts

Excel Discount Rate Formula Calculation And Examples

Terminal Value Formula Of Perpetuity Growth And Exit Multiple Method

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Discount Factor Formula Calculator Excel Template

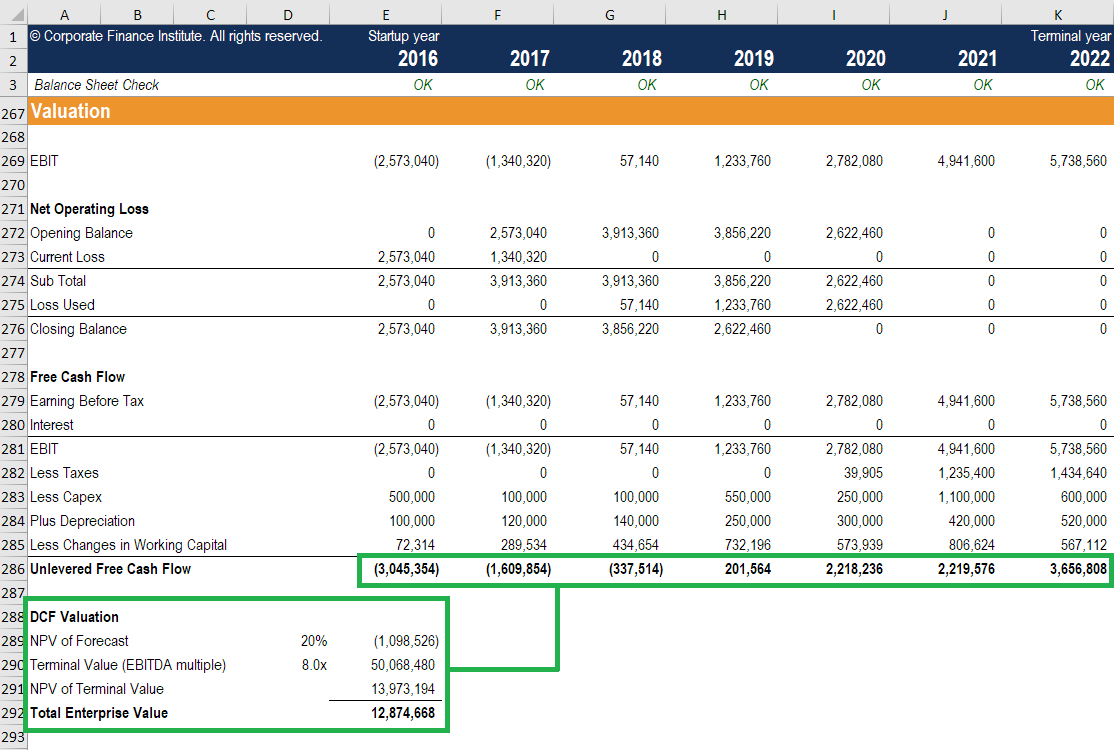

Dcf Model Full Guide Excel Templates And Video Tutorial

Discounted Cash Flow Calculator Dcf

Dcf Terminal Value Formula Financial Edge

Discounted Cash Flow Calculator Calculate Dcf Of A Stock Business Investment

Present Value Of Cash Flows Calculator

Dcf Model Training The Ultimate Free Guide To Dcf Models

Discounted Cash Flow Analysis Study Com

How To Calculate Discounted Cash Flow For Your Small Business

Discounted Cash Flow Dcf Formula Calculate Npv Cfi